Ari Peskoe, director of our Electricity Law Initiative, speaks with Staff Attorney Hannah Dobie about Ari’s new article about power sector governance, Replacing the Utility Transmission Syndicate’s Control. They discuss how FERC’s legal authority shapes regional governance, how independent decisionmaking by Regional Transmission Organizations is compromised by utilities and other incumbent firms, and why this is holding back the industry’s innovative potential.

Click here for a transcript or keep scrolling.

Links and graphic mentioned in the podcast

Ari’s first paper on RTO governance: Is the Utility Transmission Syndicate Forever?

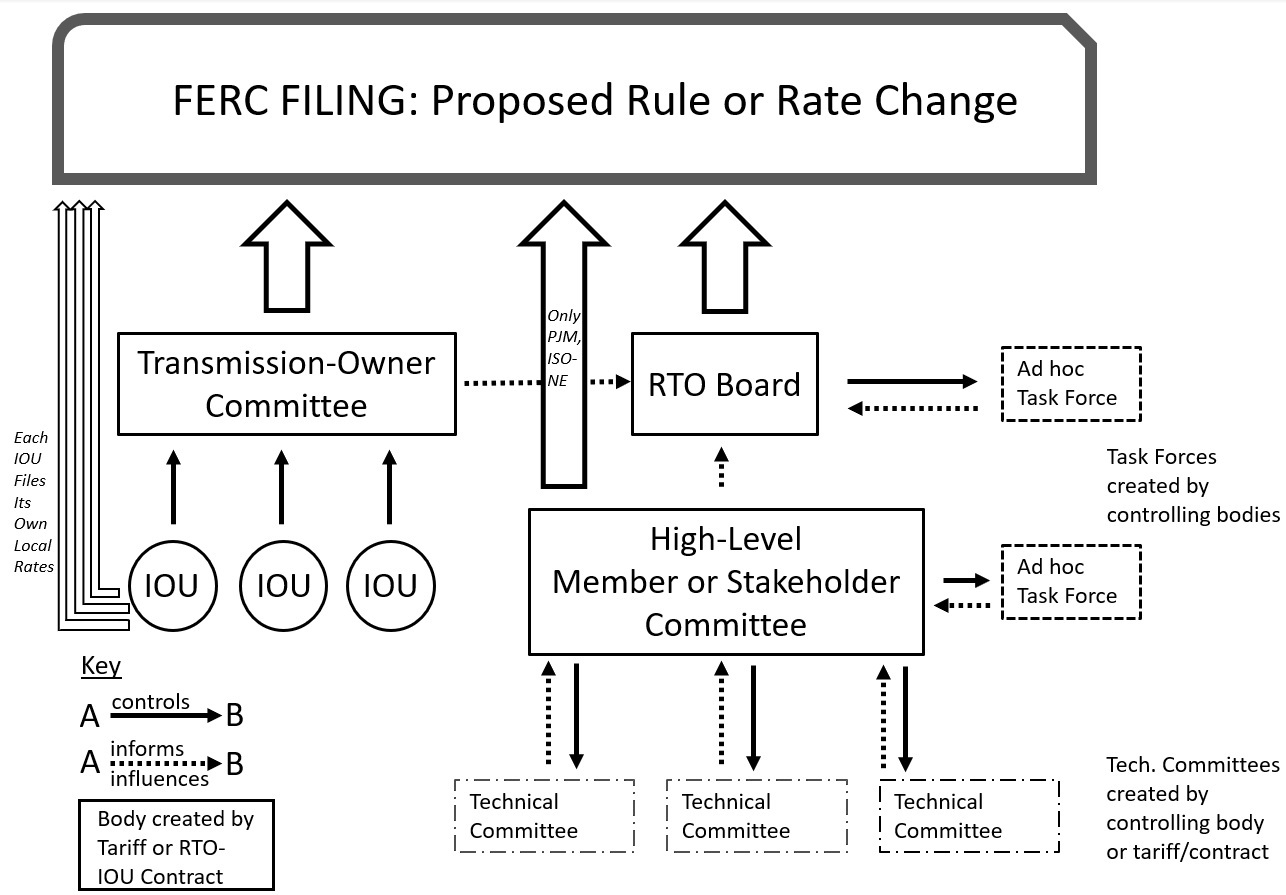

Graphic mentioned at 23:15 in podcast

Intro:

Welcome to CleanLaw, from Harvard’s Environmental and Energy Law Program. In this episode, Ari Peskoe, director of our Electricity Law Initiative, speaks with staff attorney Hannah Adobe about Ari’s new article on power sector governance titled Replacing the Utility Transmission Syndicate’s Control. They discuss how FERC’s legal authority shapes regional governance, how independent decision-making by regional transmission organizations is compromised by utilities and other incumbent firms, and why this is holding back the industry’s innovative potential. We hope you enjoy this podcast.

Hannah:

Welcome, Ari, to CleanLaw, and thank you for joining us on this episode of the podcast.

Ari:

Sure. I’m excited to talk about the paper I just put out. So just to help orient listeners, we’re going to be using a few acronyms. I’m just going to get those out of the way and tell you what they are. Most important one is RTO, that’s Regional Transmission Organization. The other one is IOU, that’s investor-owned utilities. These are the for-profit utilities that own most of our transmission in this country. Then the other big one is FERC. That’s the Federal Energy Regulatory Commission that has authority to regulate the RTOs and the IOUs and then there’s several examples of RTOs that we talk about, so these are some of the names of the RTOs. There’s SPP, PJM, MISO, and CAISO, and these are just various RTOs around the country.

Hannah:

So today we’re going to talk about, as you mentioned, your law review article that you recently wrote called Replacing the Utility Transmission Syndicate’s Control, which will be published soon in the Energy Law Journal. To start out, can you just give us a brief overview of your paper and then we’ll kind of dive deeper into the details as we go?

Ari:

Yeah, the paper is about regional governance in the electric power industry. That is, how does the industry make decisions about markets and transmission rules? These rules really affect the future of the industry, who’s allowed to generate and transmit electricity, and it influences the resource mix. How much coal, gas, renewables, et cetera do we have on the system? These are all a direct consequence of the rules that are governing utilities and market participants, so the big question that I’m investigating is who sets these rules and what are the processes that are used to determine those rules?

Hannah:

I know you wrote another article in 2021 called Is the Utility Transmission Syndicate Forever? Is this paper a follow-up to that first paper? Can you describe the paper a little bit and how this one kind of expands on the first?

Ari:

Sure. Yeah, I like sequels and so this is kind of a sequel. I mean, originally when I was writing that first paper, started out doing a project about governance, but I realized as I was digging into governance that it didn’t really make sense to talk about governance before talking about utilities and what they are and how they’re basically gatekeepers to the industry and what FERC has tried to do about it and how its progress has stalled. So I kind of did that first paper to talk about the investor-owned utility industry, which own most of the transmission, putting context why transmission ownership is sort of a gatekeeping function, and then that led me to talking about governance in this paper. But definitely, yeah, go back and read the first paper if you haven’t yet.

Hannah:

It’s a great paper. Okay, let’s dive into the substance of the paper. So you start out by giving a history of RTOs or regional transmission organizations. Can you talk a little bit about how they came about, what is an RTO, and kind of the benefits they provide to the system?

Ari:

Sure. So about 25 years ago, FERC was trying to figure out how to shift the industry from monopolies to markets and it concluded that the control that the utilities had over the transmission system was preventing the development of markets, so it did two things.

First, it required all the utilities to meet certain minimum standards with their transmission service. The basic goal was everybody should get the same service, whether you’re a utility power plant or whether you’re a non-utility power plant, everybody should be on equal footing.

But it kind of realized that wasn’t enough and it encouraged the industry, but never required it, to basically cede control over transmission that they own to a third party, and that third party is the RTO, and the basic premise is that third-party control by this RTO, which doesn’t have any financial interest in any particular market participants, would inspire confidence among non-utility companies that this would be a fair market and it would attract investment into these markets. So that was really the RTO’s main purpose, at least initially. FERC’s vision was, how do we bring competition? It thought that this third-party RTO providing transmission service would be a vehicle for enabling competition in power generation and marketing.

Hannah:

So FERC doesn’t require utilities to join an RTO, but they encourage it and they do so, in your paper you say it, “Through Order 2000, and in this order, FERC also emphasizes that independence is the bedrock,” which you mentioned. Can you talk a little bit more about the independence principle and how that applies to RTOs?

Ari:

Yeah, so again, FERC’s goal was here to kind of foster confidence in these new institutions and the service that they were providing in order to attract investment in these markets and so it’s really only criteria for how these organizations should make decisions is that they do so independently from any market participants. That is, the RTOs themselves are staffed by RTO employees, not employees of utilities or market participants and RTOs have their own boards that typically hold most of the formal authority for the market and transmission rules. So this was sort of FERC’s really only governance principle is that these RTOs make decisions independently and you mentioned sort of, yeah, if FERC never required utilities to join these RTOs, but it’s sort of initial vision of how this was all going to play out is that there would be four RTOs covering the entire continental United States, but that agenda sort of stalled.

Hannah:

You talk about how the flip side of the fact that they don’t have to join an RTO is that they can also voluntarily leave, which gives them some power. Can you talk about how that works and have utilities left RTOs before?

Ari:

Yeah, it’s usually more of a switch than a total departure. There’s only, I think, one case of a utility actually departing an RTO. It’s Louisville Gas and Electric and its sister utility owned by the same company. But there are a number of cases of utilities switching back and forth between PJM and MISO, and that requires FERC approval. But there is sort of this threat that the industry holds over RTOs and FERC, which that if we don’t like the way these RTOs are run or regulated, we can just take our ball and go home.

It’s easier said than done. I think particularly for the eastern utilities that don’t own their own power plants anymore, they’re not vertically integrated, just abandoning the RTO would, I think, raise a lot of technical questions that they’d have to solve before they could leave. But for the utilities in the middle of the country, in the RTOs that are called MISO and SPP, I think particularly MISO, this is a sort of threat that hangs over their relationship between the RTO and its utility members.

Hannah:

Right, and that’s just one of the few ways that you talk about in this paper that they can wield power over the RTO governance.

Ari:

Yeah, I would say just on that point, and most of what I’m focusing on in the paper are the written rules of the RTO, not really sort of these background factors. I try to keep the focus on the aspects of governance that are amendable, right? Things that are written down, the rules that can be changed, and changing those rules can influence a host of other factors including sort of this informal influence that utilities and other parties have.

Hannah:

Right. So after Order 2000, you talk about how utilities and power pools were the first to respond and proposed governance over RTOs with utilities holding the ultimate control, but FERC rejected that, and then the D.C. Circuit decided Atlantic City, which gave utilities more power to bargain with RTOs. Can you talk about the Atlantic City decision and utility filing rights?

Ari:

Yeah, so just to clarify the timing a bit, so the utilities that were the first movers here were previously allied with each other through what were called power pools, which was similar to an RTO except there was no independent body that was running everything. It was just run by the utilities themselves and this was all prior to Order Number 2000. FERC had a previous order that talked about these RTOs, used a different term, but it was a similar concept where FERC was encouraging the utilities to set up these independent organizations and the utilities’ initial proposals in the regions that are called PJM and the New York ISO and ISO New England were basically allowing the utilities themselves to have significant influence or control over the board of the new RTO and so FERC rejected these proposals repeatedly from the RTOs. It sort of rejected the notion that transmission ownership or the transmission owner share of retail customers in the region, it rejected the notion that these were appropriate metrics for controlling the RTO and so that the RTO really did need to have its own independent board and independent staff and decision-making authority.

Part of that independent control is control over the tariff, right? The tariff is the document that FERC regulates that sets all the market and transmission rules and FERC believed at the time that it was important that the RTO be the only entity that can file changes to the rules at FERC for FERC’s approval and ultimately the PJM utilities went to court over that issue. They said, just looking at the way the Federal Power Act was written, this is the 1935 law that gives FERC its authority over the industry’s interstate sales and service, and this is a statute that was written that is focused on individual utilities, doesn’t say anything at all about RTOs, and so the utilities argued that under this law, they have the right to file certain changes about their transmission rates and service and FERC can’t take that away and give that authority to this new RTO and the D.C. Circuit agreed with the utilities then said that FERC can’t sort of deprive the utilities of this filing right, this authority to bring to FERC certain proposed changes to transmission rates and rules.

This, I think, really compromised the independence of the RTOs because under this decision, the RTOs could only have partial control over regional rules, and it was sort of a shared governance arrangement with the utilities, and so what ended up happening after that case is the utilities and the RTOs basically negotiated for who had filing rights over which types of rules, and FERC ultimately approved the settlements between the RTOs and the utilities. But it did say in those orders that FERC sort of retained the authority to go back and reevaluate these agreements and make sure that they were not compromising the RTO’s independence. But it’s been 20 years and FERC has never kind of revisited these arrangements.

Hannah:

Right. The Atlantic City decision was in 2002 and I just want to ask one more question about the filing rights powers. So you talk a little bit about how the filer, the person who submits the application for the tariff change, has a little more power than anyone intervening and protesting. Can you talk about some of the advantages that utilities have that come with these filing rights?

Ari:

Yeah, so filing authority is really at the heart of governance and FERC’s role in this process is to ensure that whatever is filed will result in just and reasonable and not unduly discriminatory rates and those are very, by design, flexible standards and market participants and utilities often disagree about what the rules ought to be and it’s plausible that FERC could find any of those proposals to meet the legal requirements, and so filing authority is so important because really what the filer does is effectively choose between the various proposals on the table from certain types of market participants, and also the filer decides in the first instance whether to change the rules at all, and so the filer then chooses when to file, chooses exactly the scope of the filing, sort of sets the proceeding effectively before FERC. If you’re protesting the filing, you only have typically about 30 days to respond, and all FERC can do is really approve or disapprove. It doesn’t really have authority to modify the filing. So really, in a lot of ways, the tariff filer is responsible for writing the rules of the regional market.

Hannah:

Thanks for explaining that. So still in the early 2000s, you talk about how FERC attempted to take a proactive approach to regulating RTOs, and this was right before the Western energy crisis. Why did FERC retreat from more governance oversight in that early proposal?

Ari:

Yeah, so again, FERC’s vision, as I said earlier, was like four RTOs covering the whole nation. Things weren’t progressing as fast as FERC had hoped. It sort of found some other deficiencies with its earlier transmission rules and so it came out with this big proposal that it called standard market design that was basically going to impose independent governance across the entire country.

At the same time that it was releasing this proposal, it was dealing with the aftermath of the California energy crisis, and that’s a whole ‘nother podcast, but basically, the market prices in the relatively new California market increased by a factor of 10, and there were some rolling blackouts over the course of several months and FERC expended a lot of resources trying to address the situation and investigate what had gone wrong and I think there was a real crisis of confidence in these still nascent interstate wholesale markets and that led to some questions about whether this model should be extended by regulatory fiat out of FERC headquarters and there was a lot of political pushback. In part, it came from the regions of the country that still have not adopted the RTO model, and that’s the Southeast and much of the West outside of California, and ultimately, FERC had to abandon this standard market design proposal, and it really has not returned except in one small way to addressing RTO governance or trying to reform it in any way.

Hannah:

After the Western energy crisis, the California legislature required CAISO to reform its board, and FERC rejected the CAISO board as non-compliant with the independence principle and the Western energy crisis led to another D.C. Circuit decision about RTO governance. Can you talk about that decision?

Ari:

Yeah, so Atlantic City was one case we talked about. The other big case that affects FERC’s legal authority here is about the California independent system operator and it was really about whether FERC could fire the RTO board. Like I said, FERC took a lot of different approaches to try and address the situation. It basically found that the CAISO board did not meet this independence principle because, for a number of reasons, the state itself had stepped in to be a major participant in the energy market, and the governor had appointed state officials to the board and so this sort of structure was violating the principle that market participants cannot sit on the RTO board and so FERC ordered changes, CAISO took FERC to court, and ultimately, the D.C. Circuit said that FERC does not have authority to fire an RTO board.

I think there’s a big question about what the sort of scope of this case is. Does it stand for any larger proposition beyond just this limited notion that FERC can’t fire an RTO board? But again, regardless, I think this was another factor that may have given FERC some pause about continuing down this path of reforming RTOs. But ironically, this decision and some related proceedings at FERC actually provide a path forward for FERC inducing governance reforms at the RTOs.

So we can get into maybe some of the proposed solutions later, although I generally think that the value of the investigation that I’ve done about governance is really just sort of addressing and identifying the problems, and my solutions are really just out there as a punching bag for everyone, and hopefully people will build on what I’ve put out there, but kind of happy to talk about, certainly, the legal aspects of it.

Hannah:

Great, and then just last part of the history aspect, so in 2008 and 2016 and 2019, FERC does issue a few orders maintaining that it has jurisdiction over RTO governance when it comes to participation from state consumers and other customers. Can you talk a little bit about those orders?

Ari:

Yeah, the orders touch on the governance processes themselves, which I think we’ll get into, but they basically say where the RTO has a decision-making process that directly affects what the RTO proposes before FERC, FERC has authority to regulate those aspects of RTO governance. So this legal principle comes from a 2016 Supreme Court case, which was about FERC’s authority to regulate what’s called demand response in the market. The idea was FERC has authority over energy sales, but does it have authority to regulate reductions in energy use that can similarly balance the market? The Supreme Court said, “Yes, under the idea that FERC has jurisdiction over practices that directly affect energy rates,” so with regard to RTO governance, FERC has said that governance processes that determine what RTOs file before FERC similarly directly affect energy and transmission rates, and therefore, FERC has authority to regulate those matters. But FERC’s legal theory has never been tested in a federal court.

Hannah:

Great. So with that background in mind and the standards in mind, let’s turn to the next part of your paper where you talk about how RTOs are actually governed. You note that RTO-administered markets are planned and governed by technical rules that are enshrined in FERC-regulated agreements and tariffs and these are usually hundreds of pages and usually highly technical, so I applaud you for digging into those. Can you explain how RTOs are generally governed?

Ari:

So RTOs have a board, and in some RTOs it’s the board that has all the formal authority to decide what is filed before FERC, and in PJM, the rules are split across at least two agreements and the market participant members in PJM have authority over one of those agreements. Then separately, it’s important to keep in mind that really we’re talking about regional governance, not just RTO governance, and so the utilities themselves, because of that Atlantic City decision, have their own filing authority over many important transmission rules as well as in some cases market rules.

The second piece of the RTO decision-making process are basically these committee-based processes where it’s primarily market participants that are on these committees and are developing internally their own proposals for rule changes. Typically, the member committees effectively advise the RTO board, although again in PJM and to a limited extent in ISO New England, these committees can actually lead directly to a FERC filing.

Hannah:

So you talk about the committees involved in RTO governance, and these are usually sector-specific. Can you talk about how these are organized and who controls the sectors?

Ari:

Yeah, so RTO members are divided into sectors. So to give you an example, in PJM, there are five sectors. Generation owners are one sector, transmission owners, local distributors, consumers, and then other suppliers. So those are the five sectors and one of the key problems I discuss in the paper is that these sectors are the same today as they were 30 years ago, so I talk about this sector stagnation and how that entrenches power.

I can run through an example of, let’s say you are a battery developer and you want to make sure that the rules reflect the needs of this sort of relatively new technology that really didn’t exist commercially when the RTOs were started and the two potential sectors that a battery developer could join are the supply side sector generation owner and other supplier. In PJM, these are the sectors that have seen almost all of the growth, so almost all the new members are in these two sectors. The other three sectors are basically the same. It’s the same firms representing the same interests and I think this is really a key factor that’s leading the RTOs to have sort of a status quo bias because they’ve been hearing from the same players for 25, 30 years.

So again, going back to this battery developer example, you could try to join the generation owner sector, but that sector has historically been dominated by fossil fuel and nuclear plant owners who just prioritized other issues, you could join the other supplier sector, but that’s really a mishmash of just a whole host of different interests like financial traders and energy efficiency providers, et cetera, and so what really have to do is build coalitions, but the odds are really stacked against you when you are a new entrant and you’re coming into these very complicated processes for the first time.

Hannah:

You include a really helpful graphic in your article, which we’ll include in the show notes on our website for everyone to see on how that works together.

Ari:

Yeah, work in progress. There’s a lot going on with these committee-based processes and who controls which committee and who’s able to appoint task forces. I think the key thing to keep in mind is that the voting is done by sector and that sector-weighted voting, again, really tends to amplify the sort of entrenched voices in the process. The number of meetings and processes at RTOs is extensive, and it’s the larger, more established firms that have the resources to embed themselves at the RTO to establish the relationships with RTO staff and to be involved in a very detailed level.

The other aspect of this is that some of the larger companies have multiple affiliated companies, so for example, it could be that a generation company sort of has separate entities, each own various different projects, and in some of these committee-based processes, all these various affiliates are able to vote, and that really stacks the deck in favor of larger companies, and again, to the detriment of new entrants and new technology providers.

Hannah:

So within this complicated framework and with the requirement for stakeholder support to make any rule changes, and keeping in mind that IOUs do have that filing authority, you talk more about how the utilities speak with one voice on major transmission issues, particularly about competition. Can you talk about how utilities wield that power within this framework?

Ari:

Yeah, so one of the key documents is this foundational agreement between the transmission owners, which are predominantly the investor-owned utilities or IOUs and the RTO itself and that document lays out part of this shared governance framework as to sort of what is the RTO going to have filing authority over, what are the utilities going to have filing authority over, what’s going to be the scope of the RTOs authority to plan transmission, who’s going to have control over transmission rates, and how costs of new projects are allocated across the region, so this sort of foundational agreement then leads to a separate RTO committee that is exclusively for the transmission owners and is effectively controlled by the IOUs, and this transmission owner committee is the mechanism by which the utilities come together for proposing changes to the rules that they control.

So just to give you one example of how the utilities can really influence regional development, I really focus on the multi-state RTOs and there’s four of them. There’s ISO New England, there’s SPP, MISO, and PJM. In three of those, the utilities have authority over regional cost allocation and what that means is that the RTO is supposed to be planning transmission expansion projects across the region. There’s a lot of reasons why we want to expand the transmission grid, including facilitating more clean energy, but also for reliability benefits and because they can lower energy costs, but it’s the utilities that decide how these projects get paid for, and it doesn’t take a lot of imagination to realize that figuring out who pays greatly informs what actually gets built.

The other key aspect of this is that FERC has told the RTOs that when projects are paid for by more than one utility, those projects have to be developed through competitive processes, so this gives the IOUs sort of a perverse incentive to pay for projects by themselves, only one utility paying for the project in order to avoid this competitive requirement, and over the past decade, we’ve seen utilities, particularly in MISO and PJM, come forward with several proposals to change these cost allocation formulas so that they funnel more projects just to a single utility in order to avoid competition. So this cost allocation authority is really an indirect means of controlling regional transmission development.

Hannah:

You also talk about how utilities have jurisdiction over what you call wreck and rebuilds. Can you talk a little bit about that and how PJM tried to address this issue and how that worked out?

Ari:

Yeah, so this is a big issue in transmission development, and FERC has two, now three proceedings about this issue, and it’s sort of future of transmission development in this country. FERC has put forward a proposal to try to encourage more forward-looking large-scale regional development in order to kind of make sure that the industry is prepared to meet our 21st-century needs. But the utilities themselves over the past several years have been concentrating their transmission spending in small-scale local projects, including by just simply rebuilding projects they built last century, so taking them apart, and putting them back together, effectively.

The reason they can do that without any oversight is because of these RTO documents, like their foundational agreement between the RTO and the utilities as well as potentially the tariff and those documents basically give the utilities unfettered control over what happens with these, what are classified as local projects within their service territory. There’s nothing sort of natural about any of this. This is all just the rules that were written by the utilities and probably approved at the time by FERC without realizing what the long-term ramifications were going to be of this allocation of authority.

So recently, in PJM, the members, which control what’s called the operating agreement came together and filed before FERC some changes that would’ve given PJM itself greater oversight over some of these wreck-and-rebuild projects and the utilities responded by quickly coming up with their own competing proposal and filing it through that committee that they have and putting basically both proposals on the table before FERC and FERC ultimately did side with the utilities.

But the interesting part of all this is that PJM also sided with its utilities over its other members and the members who lost this proceeding, or really, it was technically two proceedings at FERC have filed a lawsuit at the D.C. Circuit, oral argument was held all the way back in November of 2022, and the D.C. Circuit has yet to issue a decision, so we’ll see if anything new comes out of that decision. But this is really, I think, a really interesting case study in governance and particularly the relationship between the utilities and the RTO itself.

Hannah:

On the same theme of how transmission-owning utilities wield power through these rules, you list a number of other subtle ways that they can influence ultimate decisions and protect their interests. But one other that I wanted to discuss, you talk about how utilities have power over the interconnection costs and can block new entrants that way. Can you expand a bit on that and how RTOs are recently trying to counter this?

Ari:

Yeah, so interconnection is the process by which new generators are able to sell energy in the market. There’s a massive backlog of projects waiting to connect to the system. There’s a number of reasons why there’s a backlog. That has to do with sort of having enough resources to process all these applications the way the RTOs and utilities process them. FERC has recently issued a rule that is trying to address at least some of these issues, so hopefully we’ll see some improvements.

But apart from all that, the utilities in RTOs have been attempting to raise the costs of interconnection, and they’ve tried to do this unilaterally with the exception of SPP, but using their own filing authority. Basically, one of the key costs of interconnecting to the system is upgrading the existing transmission system so it can accommodate the new generator’s energy injections. These costs have been rising and the utilities’ proposal was to basically take a share of those costs as profits for themselves. FERC has long authorized the generators to pay for these interconnection upgrade costs themselves and the utilities basically use their filing rights to request a piece of the action. FERC has so far rejected these efforts by the utilities, but it is just an illustration of how they can use their filing authority to achieve goals that I think are really contrary to the premise of regional markets. You can’t have a market without being allowed to enter the market. And utilities, by trying to raise the costs, are really interfering with that sort of core principle of markets.

Hannah:

Turning to the last kind of aspect of the RTO governance, the RTO boards you say are typically the final decision-makers and have filing authority over regional market and transmission rules that are not controlled by the utilities. Can you describe these boards and how they operate and the criteria by which the board members are selected?

Ari:

Yeah, so RTO boards, I think, are kind of odd ducks because they’re unusual as compared to a typical corporate board. If you look at sort of any for-profit corporation, it has a board of 10 or so individuals, a variety of backgrounds, and the board has typically high-level supervisory authority. It doesn’t get involved in day-to-day operations of the company. It leaves that to the company’s executives.

But RTO boards, as you noted, typically have the final say on market and transmission rules, and these are highly technical, in-the-weeds rules, and it strikes me that part-time board members can’t really have the mastery over all of these proposals to necessarily be making entirely informed decisions about these rules. They may have strong views about at a high level what the rules ought to do, but it seems like ultimately, the boards are really relying on information they’re getting either from the RTO staff itself or from market participants.

The RTO board members have to have certain qualifications that’s led the RTOs themselves and the board members are picked by some combination of the market participants operating through these sectors as well as existing board members. Board members have to have certain qualifications and that’s led to boards that are about 40% former IOU executives. That’s another means of sort of IOU influence kind of infiltrating what is supposed to be an independent decision-making process and I think this sort of independent board structure and independent RTO staff structure is entirely appropriate and is the right model for moving the industry forward. I think the tricky part for FERC, moving forward is to figure out how to ensure that the board is hearing from diverse participants and really hearing from companies that are pushing new technologies, new ways of operating, and planning the system and not just from entrenched power.

Hannah:

That’s a great segue into the final part of your paper where you propose some solutions. You offer proposals for FERC to induce government reforms, which you state “should aim at disentangling RTOs from their utility creators and promoting underrepresented voices in RTO governance.” So first, you propose spurring reforms with the independent entity variation. Can you talk about that recommendation?

Ari:

Yeah, so I think FERC’s position is that it has legal authority over governance, right? We talked about that earlier because it directly affects the rates that FERC regulates, so I think FERC could, in theory, issue an order that tells the RTOs what they need to do and how they need to reform their governance. My concern with that approach is that it’s going to lead to litigation and my concern is that FERC might lose. We have things like legal doctrines now, like the major questions doctrine and courts are kind of scaling back administrative agencies’ authority and so I don’t want FERC to kind of lose the authority that it already has, so I’d rather not trigger a lawsuit, even though I think FERC should win it. So my proposal is that FERC induce RTOs to comply with new governance principles. I don’t know if this will work, but that’s what I’m putting out there.

As I mentioned earlier, the experience with the California energy crisis provides a path forward here. 20 years ago when FERC found that the California ISO board was not independent, it rejected some of the proposals filed by the California ISO because those proposals were contingent on the CAISO’s independence, so FERC already had this principle that you mentioned, the independent entity variation. It’s only included this in just a limited set of rules about interconnection, and basically what FERC has said is because the RTO is independent, it doesn’t have the same disincentive that utilities have to slow down interconnection of new generators, right? If utilities control the interconnection process, they may own their own generators, and they may therefore have incentive not to put forward their best effort to interconnect those potential competitors. But where there’s an RTO that’s running the process, FERC has said it can offer sort of a different compliance option and that it calls the independent entity variations.

I think FERC should really take full advantage of that and throughout all of its transmission rules offer this independent entity variation and say it’s only available to RTOs that meet FERC’s updated governance requirements and I think to really get the industry on board with this, FERC might also consider updating its financial incentives that it offers to utilities that are RTO members and it might say, “You only get those financial incentives if your RTO meets these new governance criteria.”

Hannah:

Second, you suggest that FERC support independence with a transparency principle. Can you explain that recommendation?

Ari:

So one of the real benefits of RTOs, and I do really think that the RTO model, despite the criticisms, is the best path forward, anyway, one of the real benefits that RTOs put out a lot of information about the operations and planning of the transmission system, and that information can be used by market participants to kind of inform their investment decisions. It’s used by the market monitor. Each RTO has its own market monitor to make sure that the system is being run fairly and so this information is critical and there’s a stark contrast to the amount of information that the utility-operated systems put out.

I think they could do better, though, on transparency, so I think a principle that really says that every type of market participant should have access to the same information. One example is that in PJM, the transmission owners had a confidentiality agreement with PJM, and we don’t really know what that was used for apart from developing cost allocation and other transmission rule proposals, and it sort of prioritized the transmission owners, elevated them over market participants, and I think that’s inappropriate. PJM has sort of walked that back a little bit.

Elsewhere, there have been discussions in other RTOs about information about generator retirements and the utilities being able to keep that secret and how that can sort of distort investment, so I think there’s just generally making sure that everybody has the same information would be one way of sort of equalizing things.

Hannah:

Third, you recommend revisiting filing rights, member sectors, and rulemaking processes, including expanding RTO filing rights over regionally significant issues for underrepresented sectors. How would this work?

Ari:

Yeah, so this is kind of the big suggestion, I think, is that my diagnosis is that entrenched power basically have the loudest voices in RTOs and that’s biasing decisions in favor of the status quo and that’s holding back innovation, and so I think to remedy that, the RTOs need to make sure that the boards and staff are hearing from new entrants, are hearing from companies that are providing technology solutions that can change how the grid is operated and planned, and really, that they’re hearing from voices that counter the incumbent. So the bodies that could counteract utilities would potentially be state regulators. State regulators have some limited filing authority in two of the RTOs, I think. That could be expanded elsewhere. State regulators, of course, already regulate many aspects of utility service at the state level, and so they very well may be well-positioned to participate more robustly in regional governance.

I think FERC also should consider changing these sectors. It’s done this only once, as far as I know. In ISO New England, there’s a smaller sector that basically represents new technologies. I think this idea ought to be expanded and there ought to be sectors sort of representing innovative businesses whose products and services just didn’t exist 25 years ago and therefore have really been left out of these RTO processes and so giving them either filing authority or giving them authority in these internal processes to create task forces or staff committees in ways that right now are only open to incumbent firms. I think that would be a way to kind shake things up internally.

Hannah:

Finally, you make a more radical recommendation. You suggest that RTOs consider the CAISO governance model and also Congress’ role in this. Can you explain how these might be implemented?

Ari:

Yeah, so the California ISO has a totally different approach. Rulemaking processes don’t have these member stakeholder committees and it’s really staff that kind of issues a proposed rule change, takes comment from members, and then considers those comments and then reveals its final rule. It’s kind of more akin to a notice-and-comment process that an administrative agency would undertake. One reason maybe they can do that is because it’s a single-state RTO that is very much connected to California state policy, the governor appoints board members, and so maybe that couldn’t be extended to the multi-state RTOs.

We also should consider that despite the flaws of these stakeholder governance processes, they may very well have benefits as well. There’s some discussion in the literature that maybe they help create sort of buy-in to market rules, they help educate stakeholders, so maybe we should consider that there are some benefits to this as well. So I wouldn’t say I recommend the CAISO model, but I think it is a totally different approach to consider.

Of course, if Congress ever took up this issue, there’s a lot it could do. It could potentially address the utilities’ monopoly on filing rights. It could give FERC some new authority with respect to RTO governance, whether that’s authority to direct particular board hiring or firing authority, or simply make clear that FERC does have broad authority to reform stakeholder governance and doesn’t have to go to the sort of model that I suggest where it induced reforms. But FERC could be more proactive. FERC could also require utilities to join RTOs, so there’s a lot of things that Congress could do. I don’t really spend too much time on it because I think the lobbying power of industry would kind of get in the way here, but we shouldn’t forget that ultimately Congress is making kind of the final decisions here, whether to act or not act.

Hannah:

Are there any open governance proceedings that we should be watching that may provide a venue to incorporate the proposals that you suggest?

Ari:

So I think there are still two open proceedings about what’s called the liaison committee at FERC and this is a committee that just sort of illustrates again how incumbent firms really enjoy a lot more influence. So there’s this committee that is again divided by based on these five sectors in PJM that meets with the board, so they have sort of an exclusive audience with the board prior to the board’s official meetings where they decide what’s going to be filed before FERC. There are, I think, three delegates from each sector, and in many cases, these delegates are representing sort of the entrenched firms that have been there for a very long time and these meetings are closed to other members or other interested parties such as state regulators.

So I think there are pending complaints filed separately by the West Virginia Public Service Commission that wants access to this meeting and wants to know what’s being said to the board. Then separately, I believe the market monitor in PJM, which is independent of PJM itself, it’s its own kind of separate entity, I believe also has a complaint about this liaison committee, so again, it’s just an example of how some of these decision-making processes are kind of stacked in favor of the incumbent firms.

Hannah:

While you suggest all these changes for RTO governance, at a higher level, you explain that RTOs are the better model compared to sort of the non-RTO regions for transmission planning and expansion. Can you expand upon that a little bit?

Ari:

Yeah, I mean, I think that’s a good place to close out on because despite these criticisms, I think independent regional governance that RTO provides is far superior to just the utility-run systems. Part of it’s the information transparency, it’s the openness of the markets that allows for new entrants, it’s the fact that the RTO itself doesn’t have a profit motive, which means it ought to be more open to innovation. We’re at a point in the industry where I think technology is playing such a critical role in moving the industry forward, but really, what I’m trying to do with this article is make sure that governance is not impeding progress and that we want the RTO to really be an engine for innovation and progress and not be held back by utilities or by incumbent generators that really benefit from the status quo.

Hannah:

Just one final question that I know everyone wants to know here. Are you going to write a third transmission syndicate article to complete the trilogy?

Ari:

Yeah, I said I like sequels, but I really like trilogies, so it’s on my to-do list, but I’m a slow writer, and so maybe we’ll come back again in a couple of years.

Hannah:

Well, thanks so much for writing this article and for taking the time to talk about it on CleanLaw today.

Ari:

Great. Thanks so much.